Here’s a rundown of the different types of assets a business can possess, and the type of assets that are considered to be plant assets. Plant assets are different from other non-current assets due to tangibility and prolonged economic benefits. It’s also important for companies to track their PP&E in case they need to sell assets to raise money. While most fixed assets depreciate over time and are not easily converted to cash, some assets such as real estate can increase in value over time, providing a company with a possible option for raising cash.

The lessee gets to count the improvement value for the duration of the lease term. The Sum of Years’ Digits depreciation method divided the depreciation expenses every year by a fraction based on the number of remaining years. The Straight-Line method depreciates an equal amount of $50,000 from the opening value each year for 7 years until the asset’s value reaches the salvage value of $50,000. The image below shows the opening, depreciation, and closing values for 7 years. Buildings are structures like factories, offices, warehouses, and other places where businesses produce goods or provide services. Making informed decisions based on instrumentation data and equipment conditions can have a profound impact on plant profitability and performance.

However, it is still included as a tangible asset on the balance sheets of the companies that own and operate the plants. In addition, plant assets that are used for the production of goods or services are not considered to be assets of a particular business. The key characteristics of plant assets are their revenue generation focus, tangibility usefulness, and how long an asset’s usefulness can last. Plant assets are reported differently than other assets on a business’s accounting sheets. Plant assets lose value over time through general use, which is called depreciation.

Presentation of Plant Assets

Depreciation helps to accurately show the asset’s reduced value and plan for its replacement when the value becomes zero. In accounting of plant assets, we will see where a company records the purchase of an asset, depreciation as well as disposal. Traditionally, non-mission-critical equipment has been monitored by periodic operator rounds (once per day or less) or is unmonitored altogether. This method brings concerns of data accuracy, operator time and cost to conduct the rounds and slow reaction times in case of a failure. But industry innovations can improve the monitoring and plant asset management of this type of equipment as well. It’s impossible to manufacture products without equipment and machinery, or a building to house them.

South Side Couple Creates Plant-Based Detergent, Launches … – WTTW News

South Side Couple Creates Plant-Based Detergent, Launches ….

Posted: Sat, 29 Jul 2023 20:13:12 GMT [source]

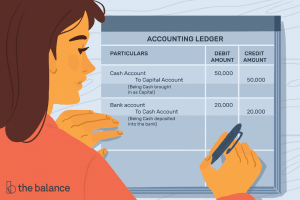

Property, plant, and equipment are recorded in a company’s balance sheet and need to be calculated appropriately. Determining the cost of constructing a new building is often more difficult. Usually this cost includes architect’s fees; building permits; payments to contractors; and the cost of digging the foundation. Also included are labor and materials to build the building; salaries of officers supervising the construction; and insurance, taxes, and interest during the construction period.

Main Purposes of Financial Statements (Explained)

Plant assets can be any asset used to make money that has both a useful life of more than a year and does not directly become part of the product itself. Plant assets are usually very difficult to liquidate and turn into cash. This makes them different from other types of assets such as liquid assets, inventory, or intellectual assets.

- It’s important to know where a company is allocating its capital, whether the company is making capital expenditures, and how the company plans to raise the capital for its projects.

- In addition, market revenues supported by region and country ar provided within the report.

- Today, plant assets are often referred to as Property, Plant, and Equipment (PP&E).

- These reports deliver an in-depth study of the market with industry analysis, the market value for regions and countries, and trends that are pertinent to the industry.

- These assets are a subset of the fixed assets classification, which includes such other asset types as vehicles, office equipment, and intangible assets.

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization. It’s important to know where a company is allocating its capital, whether the company is making capital expenditures, and how the company plans to raise the capital for its projects. The below table shows the different depreciation calculations over 7 years of useful life using four different methods.

Characteristics of Plant Assets

Its long-term carcinogenic effects on humans are unknown, but one two-year study found it caused cancer in female mice that inhaled the gas, according to the U.S. It will likely be weeks before Dow says why the fire occurred, but an early dispatch from a DEQ field inspector issued sometime after July 16 provided a glimpse into the early stages of the firefight. Ethylene oxide is a highly flammable, colorless gas and is a potent human carcinogen with long-term exposure, the U.S. Greg Langley, DEQ spokesman, said the « ongoing » air release likely stems from smaller releases expected to occur as the company removes the material from storage tanks, lines and damaged equipment in the Glycol II Unit. Big producers have in recent years heavily promoted gas as a transition fuel as it creates lower emissions when burned than coal, but environmentalists have resisted that push.

The presentation may pair the line item with accumulated depreciation, which offsets the reported amount of the asset. Broadly speaking, an asset is anything that has value and can be owned or used to produce value, and can theoretically be converted to cash. In business, assets can take several forms — equipment, patents, investments, and even cash itself.

IAS 16 defines them as physical assets that are used to produce revenue or for administrative purposes and are expected to be in use for more than one accounting period. Buildings are assets that include any structure or facility that a business builds or owns on their property. Buildings are typically one of the most valuable assets of a company in addition to owned land. A business might own outsourcing bookkeeping guide small buildings like office space or a small storefront, or larger structures such as storage facilities, warehouses, or large headquarters for their employees. The expected useful life of the machine is 7 years, and the salvage (scrap) value after 7 years will be $50,000. The land is a business area where a company establishes its factory or office to manufacture goods or provide services.

What are the four characteristics of plant assets?

Plant assets represent the asset class that belongs to the non-current, tangible assets. These assets are used for operating the business functions and generating revenues in the financial periods. Vehicles, office equipment, and buildings are included in the subcategories of the fixed assets classification. The fixed asset classification is used to categorize the assets in a company’s balance sheet. Fixed Assets are assets that are fixed in nature and are not subject to change. Plants are long-term fixed assets that are used to make or sell products and services.

However, land improvements, including driveways, temporary landscaping, parking lots, fences, lighting systems, and sprinkler systems, are attachments to the land. Owners record depreciable land improvements in a separate account called Land Improvements. They record the cost of permanent landscaping, including leveling and grading, in the Land account. Property, plant, and equipment (fixed assets or operating assets) compose more than one-half of total assets in many corporations. These resources are necessary for the companies to operate and ultimately make a profit.

The importance of differentiating plant assets over other assets is for accounting practices, in particular for tax reporting and financial planning. Plant assets are typically the largest investments the business owns and the most significant when it comes to balancing the financial books. Today, fixed assets or plant assets are considered Property, Plant, and Equipment (PP&E). PP&E assets are long-term investments for a business that have a long lifetime compared to other types of assets. The name plant assets comes from the industrial revolution era where factories and plants were one of the most common businesses. This category of assets is not limited to factory equipment, machinery, and buildings though.

Plant assets have many diverse characteristics that play a role in the business. When an asset depreciates, the company either sells or replaces it, known as the disposal of the asset, which can either result in a gain or loss. Such disposal changes the asset’s ownership, reduces unnecessary damages, and ensures proper analysis of the company’s financial position. An alternative strategy used by some is “run-to-failure”, especially if a piece of equipment is deemed as “non-critical”. But this too leads to additional downtime and surprise equipment failures, which can be extremely costly and frustrating. The best way to manage your assets is to use an accounting software application that simplifies the entire asset management process from the initial acquisition to asset disposal.

NRG Energy’s Pivot Amid Power Sector Change – POWER magazine

NRG Energy’s Pivot Amid Power Sector Change.

Posted: Tue, 01 Aug 2023 03:26:09 GMT [source]

The straight-line method’s illustration has been given in the above example. The straight-line method is the most commonly used method in most business entities. It is also called a fixed-installment method, as equal amounts of depreciation are charged every year over the useful life of an asset. In the same way, a company can sell its assets to a third party and use them for its own benefit. This is called an “asset sale,” and it is not considered to be a sale of a tangible asset.

Global Patty Forming MachinesMarket Industry Outlook, Future Trends, Insights and Sustainable Growth Strategies for 2023-2031

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. The same process will be repeated every year at the end of the financial year. The IRS defines a REIT as an investment company that owns and operates a real estate asset that generates income from the sale or lease of that asset.

Depreciation also helps spread the asset’s cost out over a number of years allowing the company to earn revenue from the asset. Fixed assets have a useful life assigned to them, which means that they have a set number of years of economic value to the company. Fixed assets also have a salvage value, which is the value remaining at the end of the asset’s life. Improvement value is difficult to transfer over when new ownership takes over an asset. For example, a business leases out an asset with its improvements attached to an individual. In this case, the lessor gets ownership over improvements at the end of a leasehold improvement.